Feb 4, 2018

Bitcoin Investors vs Bitcoin Business

With the spectacular rise (and recent fall) of Bitcoins, Alt-Coins and other Cyrpto-currencies lets have a look at what the tax implications are of transacting in these assets.

The tax treatment is

Jan 7, 2018

SMSF Annual Obligations

You have a number of obligations as an SMSF trustee, and harsh penalties may apply if you fail to meet them. Here's a checklist of important areas you'll need to take into account each year.

Pay the

Dec 3, 2017

Tax Residency of Individuals

An individual's tax liability depending on whether a person is considered to be an Australian tax resident or a foreign resident. Australian tax residents are assessed on income from worldwide

May 28, 2017

2017-18 Budget Announcement

The budget announcement by Scott Morrison on 9 May 2017 was relatively subdued in relation to tax reform when compared to prior years. The budget saw a change in philosophy by the Coalition

May 9, 2017

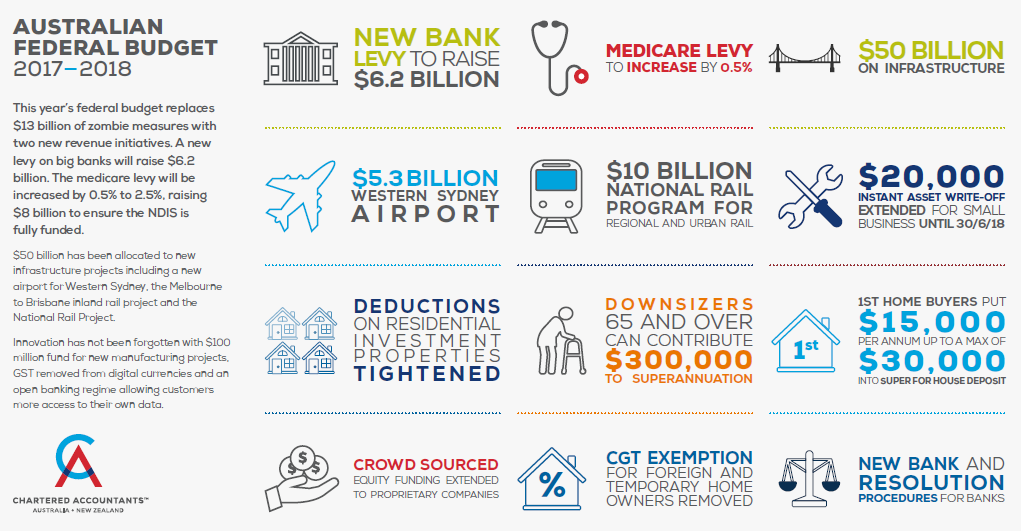

Australian Budget 2017-18

A snapshot of the highlights from the Australian Federal Budget for 2017 - 18 is shown in the infographic above courtesy of the Chartered Accountants Australia and New Zealand.

For further in depth

Mar 29, 2016

Changes from 1 July 2016

Below is a list of changes that are to come into effect from 1 July 2016. These changes were highlighted in the 2015 budget, further changes may come into effect following the upcoming budget on May

Feb 2, 2016

Predictions for 2016

Another year has passed and this year has already begun with a lot of volatility in the share markets, interest rates are at an all-time low. Here are three of our predictions for 2016:

Businesses

Nov 10, 2015

Specialist Startup accountants

Commencing a startup requires a lot of hard work and some luck along the way and if your one of those who have been successful to navigate your business through those lean years then your focus

May 13, 2015

2015 Federal Budget Summary

The 2015/16 budget announcement was small business friendly and in general well received. We have summarised a number of the key announcements below:

SMALL BUSINESSES (TURNOVER LESS THAN $2