Feb 14, 2024

No Super, No Life!

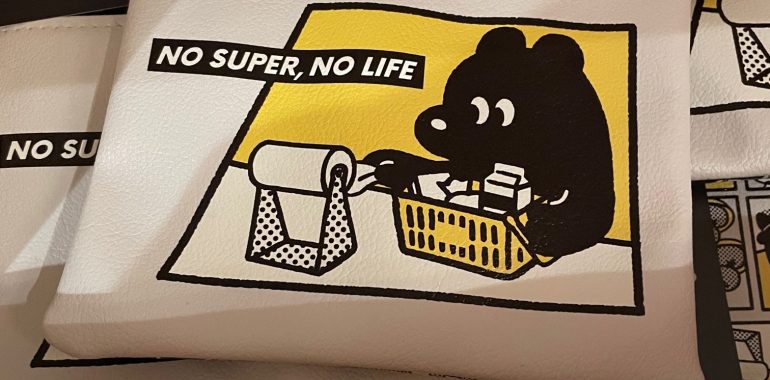

I was travelling in Japan on a family holiday recently and browsing a stationary store came across a number of pictures with the caption “No Super, No Life”. This is probably more relevant in ...